MAD Macro - The Bond and the Race Horse

Too Slow Powell Needs to Cut by 3%

Your Joking, a Bond? I’d Be a Retired Race Horse

It’s an interesting time to be a sovereign bond. James Carville, the Ragin’ Cajun, famously said he wanted to come back as a bond because then he could intimidate everyone. I imagine Bill Clinton thought Carville was crazy because he wanted to come back as a Triple Crown winner at Jonabell Farm in Lexington, KY. Instead, Clinton hung out with Jeffery. Greenspan, Rubin, and Summers revered the bond market. They respected the bond vigilantes and balanced the fiscal budget to win over the bond market. It worked. The bond market loves balanced budgets. Today, the global economy is running on deficit spending and cracks are starting to show up in sovereign bond markets. This week, German and Japanese bond yields have been rising due to concerns over deficit spending. Yesterday, U.S. bond yields rose on concerns over tariff inflation. The WSJ editorial board has an article today on tariff inflation, linked here. It’s titled, “Trump Tariffs Hit Consumer Prices”. When Trump won, Scott Bessent said that as Treasury Secretary he would focus on keeping 10yr yields low. That was reassuring for bond investors. Fast forward and Trump wants “Too Late” Powell to cut interest rates by 300 basis points. Risky business, cutting rates with tariff inflation starting to show up in some sectors of the economy. Richard Nixon and George Shultz pressured Arthur Burns to cut interest rates so Nixon could be reelected. It worked, Nixon won, but it was not so good for the bond market or inflation. That was the birth of the White Walker Bond Vigilantes. Is winter coming? Yesterday Jamie Dimon criticized Trump’s attacks on “Too Late” Powell. The WSJ article is linked here. It’s titled, “Dimon Defends Fed Independence After Trump Attacks”.

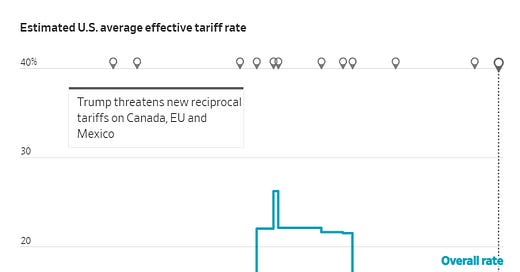

Greg Ip has a good article in today’s WSJ on the Trump tariffs, linked here. It’s titled, “Forget TACO. Trump Is Winning His Trade War.” I included a chart from the article below. Greg points out it’s becoming clear that the expected trade agreements are actually permanent tariffs dictated by Trump. To quote from the article, “Today, he leads the world’s largest economy with the largest military. Everyone else needs the U.S. more than vice versa, and Trump assumes that he can thus dictate terms and that others have to live with them”. So far the markets are ignoring the risks that the permanently higher tariffs slow the global economy or cause inflation in the U.S.

Markets are mixed this morning after pulling back a little yesterday on the CPI report. Today we get the PPI inflation report. It’s expected to be 2.5% year-over-year vs 2.6% last month. Ex-food and energy, it’s expected to be 2.7% year-over-year vs 3% last month. Bitcoin was down yesterday on concerns that the three expected crypto bills were stalled in Congress. Apparently, Trump had the Republican holdouts to the White House last night and now they are expected to pass the legislation this morning. It would be fun to watch how Trump changes the minds of holdout Republicans. So bitcoin is higher this morning.

I updated the U.S. Dollar Index, U.S. 10yr yield, U.S. 10yr-2yr yield spread, WTI crude oil, NY copper, spot gold, NYSE Arca Gold Miners Index, bitcoin, Strategy, S&P futures, NASDAQ 99 futures and DOW futures charts below.

The dollar and interest rates are unchanged after both were higher yesterday on the CPI report.

Crude oil and NY copper are both a little lower. Gold is higher and the NYSE Arca Gold Miners Index should also open higher. Bitcoin is higher and Strategy is also due to open higher.

The S&P and NASDAQ 99 futures are slightly lower and the DOW futures are unchanged. There is a developing divergence on the charts between the S&P and NASDAQ 99 vs the DOW. Both the S&P and NASDAQ 99 have broken out to new all-time highs. The DOW is forming a double top.

IMPORTANT DISCLOSURES AND DEFINITIONS

Unless otherwise stated, Bloomberg is the source of all data and charts.

S&P 500 futures are a type of derivative contract that provides a buyer with an investment priced based on the expectation of the S&P 500 Index’s future value. Nasdaq 100 futures are commodities futures products traded within the equity futures sector. West Texas Intermediate (WTI) oil is a benchmark used by oil markets, representing oil produced in the U.S. Brent Crude Oil is a blend of crude oil recovered from the North Sea in the early 1960s, whose price is used as a benchmark for the commodity's prices. The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners. UBS Bloomberg Constant Maturity Commodity Index is a total return rules-based composite benchmark index diversified across commodity components from within specific sectors. Index performance is not illustrative of fund performance. It is not possible to invest directly in an index.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The securities/ financial instruments discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security/financial instrument, or to participate in any trading strategy.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.