MAD Macro - Superman Jensen Paid for his Education

Look At Jensen Fly Like Superman

Tin Man Wants to Pay for the Protestors

Jensen Huang went to Oregon State University because of the low cost in-state tuition. We can assume he and his family paid for his education. It paid off. I guess the Tin Man is making the same bet by forgiving more student loans. Unfortunately, it’s a very poor idea politically. The Tin Man assumed that as president, math would not be required. 37% of Americans have completed a college education. All most all of those voters who completed their college education, either paid for it or have paid off their loans. The Tin man is pissing off a lot of voters. Buying votes is not a bad idea, but someone should have done the math first. The student votes the Tin Man is buying are the same students who call him “Genocide Joe”. Jake and Antony are busy running the world. Dr. Jill is supposed to be handling the domestic stuff. Unfortunately, math was not required for an English PhD. Daniel Henninger has a good opinion article in today’s WSJ about buying votes, it’s linked here. It’s titled, “Joe Biden’s 2024 Election Bribes”.

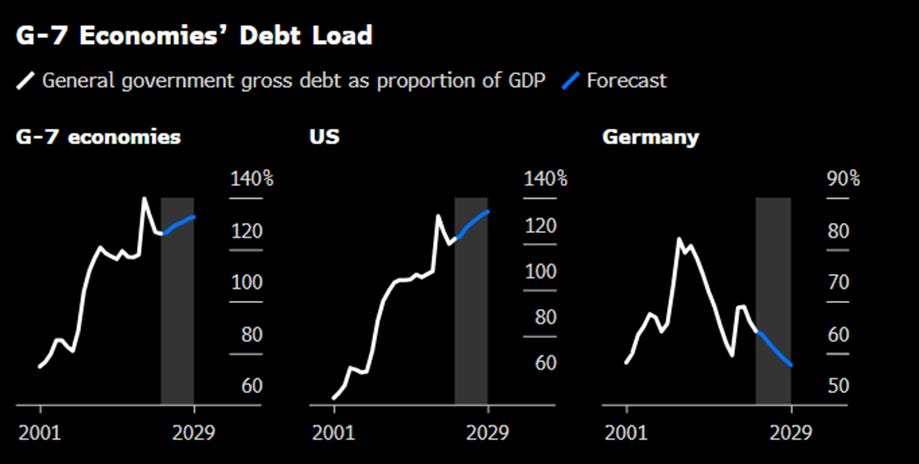

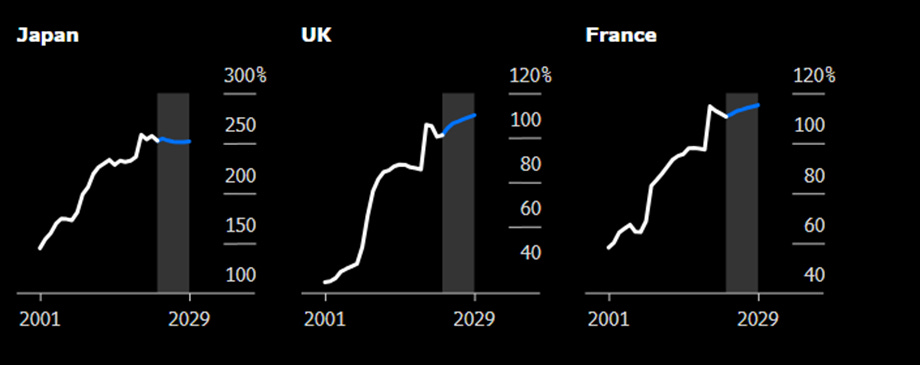

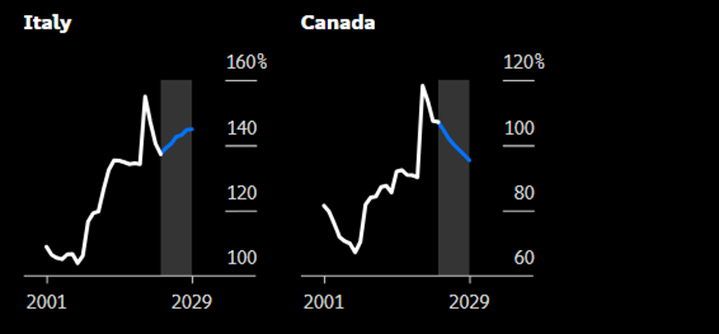

The G7 Finance Ministers are meeting in Italy. Apparently, deficit math is not on the agenda. It’s interesting. The Finance Ministers are supposed to be dealing with the biggest financial problems. Math is definitely required to be a finance minister, so why are they avoiding deficit math? Easy-there are no easy answers so let’s ignore the problem. I included some interesting charts on G7 deficits below. Strong bull markets. Only Germany is trending down. Maybe math is required in Germany. There are a lot of elections this year and now the UK has called for elections. No one wants to run on reducing deficits, it’s such a downer. At some point the markets might notice the problem. Both the Tin Man and the Orange Mad King I are ignoring the problem. Will 2025 be the year of fiscal wreckoning? One of the many crazy things about this year’s U.S. election is who ever wins will probably have no chance at a successful presidency.

Markets are due higher today thanks to Jensen Huang’s investment in a college education. He had math in college. Nvidia beat and raised, which is what all good technology companies do. Using the basic math Jensen had Oregon State University he doubled the dividend and split the stock. Again, easy math. Too much cash, give it back and $1,000 divided by 10 = 100. Jensen’s success is helping the entire market and driving down market volatility. The CBOE Volatility Index is making new 5 year lows today. That’s how the math works. If the market only goes up, volatility goes down.

MAD Macro missed a day so I have a lot of charts today. There are some interesting movements. Gold and copper, after making new all-time highs this week have pulled back sharply. Crude oil continues to consolidate in a narrow range. Bitcoin is testing all-time highs on hopes for an ether ETF approval from the SEC. The S&P and NASDAQ 100 are opening at new all-time highs this morning on Jensen’s math education.

I updated the U.S. Dollar Index, Japanese yen, U.S. 10yr yield, U.S. 10yr-2yr yield spread, WTI crude oil, NY copper, London 3 month copper weekly, spot gold, bitcoin, ether weekly, Hang Seng Index, CBOE Volatility Index, S&P futures and NASDAQ 100 futures charts below.

The dollar is a little lower and the yen is also a little weaker. Interest rates are a little lower and the curve is more inverted. In fact the 10yr-2yr spread is below the 200 day.

Crude oil is higher today but still stuck in a very narrow range. Spot gold and copper are lower after both made new all-time highs this week. Bitcoin is unchanged after testing all-time highs this week on the hopes for an ether ETF. I included a longer term ether chart for perspective.

The Hang Seng was lower last night. I included a longer term chart for perspective. The CBOE Volatility Index is making new 5 year lows this morning. Both the S&P and NASDAQ 100 futures are higher on Superman Jensen.

IMPORTANT DISCLOSURES AND DEFINITIONS

Unless otherwise stated, Bloomberg is the source of all data and charts.

S&P 500 futures are a type of derivative contract that provides a buyer with an investment priced based on the expectation of the S&P 500 Index’s future value. Nasdaq 100 futures are commodities futures products traded within the equity futures sector. West Texas Intermediate (WTI) oil is a benchmark used by oil markets, representing oil produced in the U.S. Brent Crude Oil is a blend of crude oil recovered from the North Sea in the early 1960s, whose price is used as a benchmark for the commodity's prices. The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners. UBS Bloomberg Constant Maturity Commodity Index is a total return rules-based composite benchmark index diversified across commodity components from within specific sectors.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The securities/ financial instruments discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security/financial instrument, or to participate in any trading strategy.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.