MAD Macro - Saylor, "I Will Keep Buying Bitcoin Forever"

I Keep Buying, Who Is Selling??

Maybe I Should Try Prosecuting Bad Guys

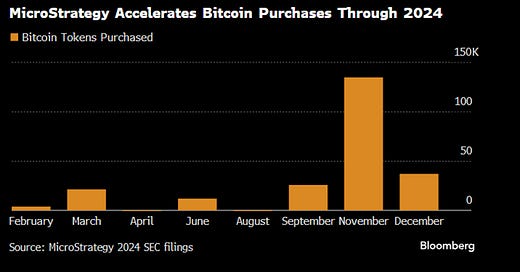

Michael Saylor keeps buying bitcoin in size. He must wonder why it’s not going up. The last three weeks he has spent almost $10 billion buying bitcoin, all at about $98,000. It’s still trading at $98,000. Who the heck is selling? He spent $2.1 billion in the last week to buy 21,550 bitcoin at an average price of $98,800. MicroStrategy is now the proud owner of 423,650 bitcoin at an average price of $60,350. I think Michael Saylor and his bitcoin strategy are both ridiculous. I found some recent quotes from Michael that make my point perfectly. Michael said the following in a recent interview, “Bitcoin is going to appreciate against the U.S. dollar forever. I’m sure that I will be buying bitcoin at $1 million a coin – probably $1 billion a day of bitcoin at $1 million a coin.” Someone call the hospital and tell them to bring a strait jacket.

Alvin Bragg lost a high profile case yesterday. Maybe he should focus a little more on prosecuting the bad guys. It might help NYC to have the Manhattan District Attorney working to keep the city safer instead of trying to get headlines. Maybe bringing the Stormy case against Trump and the Danial Penny case he lost yesterday was a waste of city resources. Next up, Alvin has a slam dunk case against Luigi Mangione for killing UnitedHealthcare CEO Brian Thompson. I hope he does not find some political reason to not bring first degree murder charges. The Luigi story is a strange one, that is for sure, but a bad back should not keep Alvin from pursuing first degree murder charges.

The Syrian civil war was amazing and now Israel is destroying all of Asaad’s chemical weapons and the U.S. is bombing ISIS. Iran and Russia are helpless and can only watch from the sidelines. Thank you, Bibi, you have successfully reestablished strong deterrents against Iran and Russia’s plans to control the Mideast.

Markets are mixed today after a down day yesterday. I added the Hang Seng Index chart today. It rallied sharply early last night on the China easing story but finished on the lows in what looks like a technical failure on the chart. I am still watching bitcoin as the bellwether market for risk assets. Bitcoin traded down to $95,000 but it is still trading around the $98,000 level where Michael Saylor keeps buying more bitcoin. I assume he is still buying. He says he will never stop. Tomorrow we get the CPI inflation report and the Fed meeting is next Tuesday and Wednesday.

I added two charts showing MicroStrategy’s bitcoin buying and convertible debt sales. The one way bet is getting bigger. I updated the U.S. Dollar Index, U.S. 10yr yield, U.S. 10yr-2yr yield spread, WTI crude oil, NY copper, spot gold, bitcoin, Hang Seng Index S&P futures, NASDAQ 100 futures, DOW futures and GDX VanEck Gold Miners ETF charts below.

The dollar and interest rates are both a little higher and the curve has steepened a little this week.

Crude oil and copper are a little lower and gold is higher. Bitcoin is close to unchanged trading near 98,000.

S&P and NASDAQ 100 are higher and the DOW is unchanged. GDX should open a little higher on the higher gold prices.

+Returns less than one year are not annualized

The performance data quoted represents past performance. Past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Please call 800.826.2333 or visit vaneck.com for performance current to the most recent month ended.

GDX Gross Expense Ratio – 0.51%, Net Expense Ratio – 0.51%

Van Eck Associates Corporation (the "Adviser") has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding acquired fund fees and expenses, interest expense, trading expenses, taxes and extraordinary expenses) from exceeding 0.53% of the Fund's average daily net assets per year until at least May 1, 2025. During such time, the expense limitation is expected to continue until the Fund's Board of Trustees acts to discontinue all or a portion of such expense limitation.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

(c) Van Eck Securities Corporation, Distributor, a wholly-owned subsidiary of Van Eck Associates Corporation

IMPORTANT DISCLOSURES AND DEFINITIONS

Unless otherwise stated, Bloomberg is the source of all data and charts.

S&P 500 futures are a type of derivative contract that provides a buyer with an investment priced based on the expectation of the S&P 500 Index’s future value. Nasdaq 100 futures are commodities futures products traded within the equity futures sector. West Texas Intermediate (WTI) oil is a benchmark used by oil markets, representing oil produced in the U.S. Brent Crude Oil is a blend of crude oil recovered from the North Sea in the early 1960s, whose price is used as a benchmark for the commodity's prices. The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners. UBS Bloomberg Constant Maturity Commodity Index is a total return rules-based composite benchmark index diversified across commodity components from within specific sectors.

An investment in the VanEck Gold Miners ETF (GDX) may be subject to risks which include, but are not limited to, risks related to investments in gold and silver mining companies, special risk considerations of investing in Australian and Canadian issuers, foreign securities, emerging market issuers, foreign currency, depositary receipts, small- and medium-capitalization companies, equity securities, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares, non-diversified and index-related concentration risks, all of which may adversely affect the Fund. Emerging market issuers and foreign securities may be subject to securities markets, political and economic, investment and repatriation restrictions, different rules and regulations, less publicly available financial information, foreign currency and exchange rates, operational and settlement, and corporate and securities laws risks. Small- and medium-capitalization companies may be subject to elevated risks.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The securities/ financial instruments discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security/financial instrument, or to participate in any trading strategy.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data.