MAD Macro - MBS and Putin Joking About an Oil Embargo

These Production Cuts Are Not Working, Embargo Time!

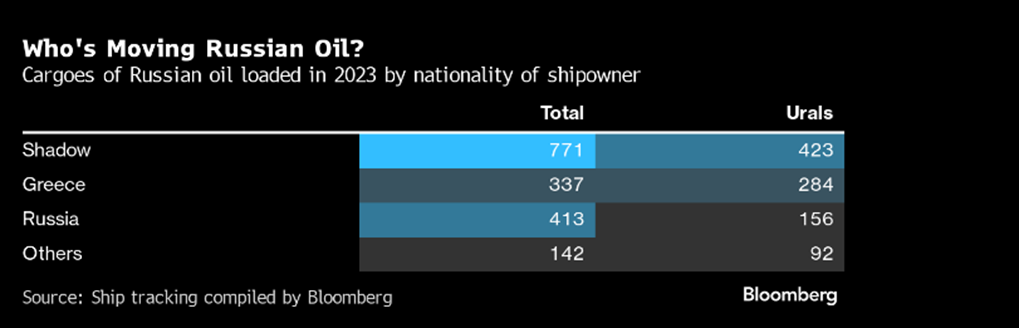

Putin is visiting the United Arab Emirates this morning and Saudi Arabia this afternoon. Last time Putin and MBS were laughing together it was about killing people. Today they are talking about oil prices and wars. There is nothing to joke about today. OPEC+ production cuts are not working, prices are falling. The Ukraine war is a stalemate and Israel is kicking Hamas’s ass. Tomorrow, Iranian President Ebrahim Raisi is going to visit Putin in Moscow. So today, Putin and MBS are working on oil prices and tomorrow Putin is buying more drones from Iran.

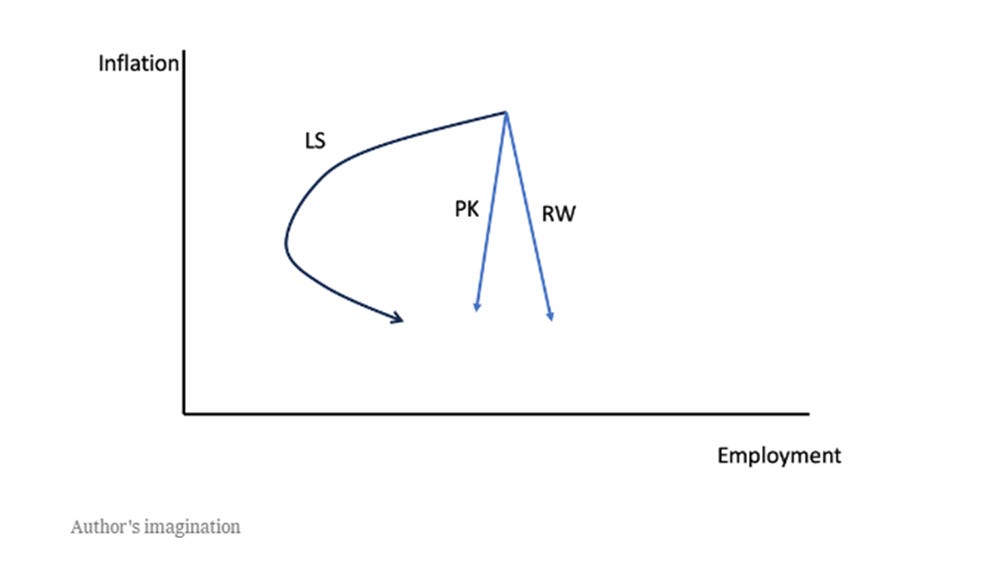

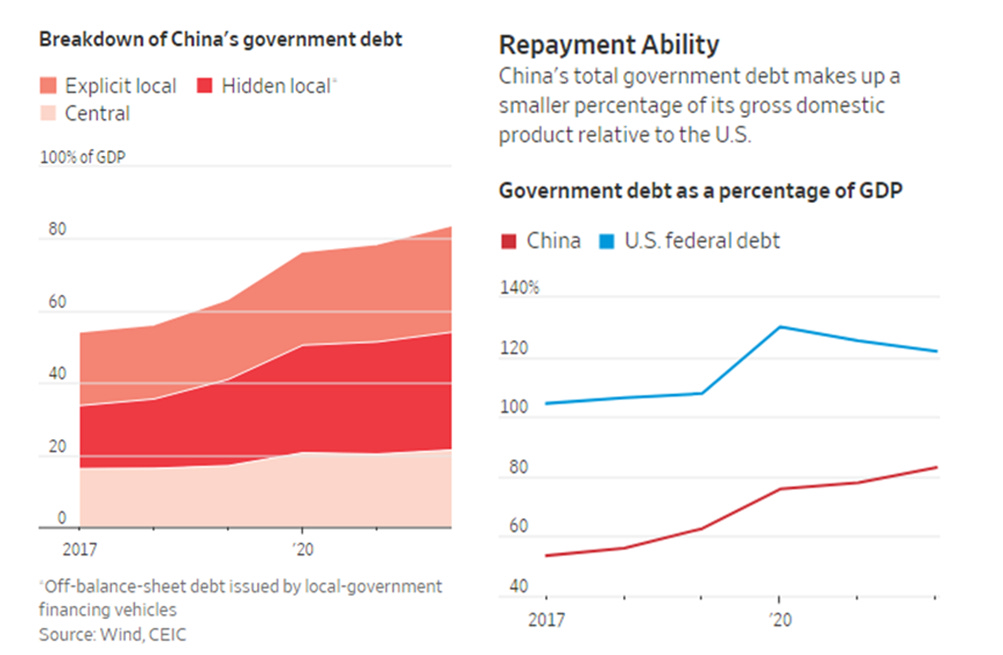

The WSJ has a good front page article on China’s hidden-debt problem, linked here. China’s debt might be hidden but ours is very public and it’s $33 trillion. It’s also larger than China’s as a percentage of GDP. Interesting unanswered question about China’s and the U.S.’s growing debt is when does it actually become a problem or when does it crowd out the private sector? The NYT has an interesting article on Xi asserting tighter control of finance, linked here. Both of these articles are definitely worth reading. I guess Xi could take control of the entire financial system and fix his debt problem. We might need some inflation to fix our debt problem. Speaking of inflation, my favorite lefty economist, Paul Krugman, has a funny article in today’s NYT about “vibeflation”, linked here. I included a chart from the article. You will need to read the article to understand the chart. It says it is the author’s imagination. I think it’s Paul’s brain on drugs.

Markets are higher this morning and bitcoin is the main event this week. The bitcoin ETF rocket ship took off this week and it looks like a moonshot. Next stop Mars. We get the ADP Employment report at 8:15 this morning. It’s expected to be 130,000 up from 113,000 last month. Yesterday’s JOLTs report was a jolt. Job openings fell more than expected and 10yr yields made new lows yesterday on the softer employment report.

I updated the U.S. Dollar Index, U.S. 10yr yield, U.S. 10yr yield weekly, WTI crude oil, spot gold, bitcoin, S&P futures and NASDAQ 100 futures charts below.

The dollar is unchanged and interest rates are a little higher this morning after making new lows for this decline yesterday on the JOLTs report.

WTI crude oil is lower and starting the test the $67 to $72 support level. Gold is unchanged and holding a minor support level. Bitcoin is also unchanged but has been riding a rocket ship ETF rally this week.

S&P and NASDAQ 100 futures charts are a little higher this morning.

IMPORTANT DISCLOSURES AND DEFINITIONS

Unless otherwise stated, Bloomberg is the source of all data and charts.

S&P 500 futures are a type of derivative contract that provides a buyer with an investment priced based on the expectation of the S&P 500 Index’s future value. Nasdaq 100 futures are commodities futures products traded within the equity futures sector. West Texas Intermediate (WTI) oil is a benchmark used by oil markets, representing oil produced in the U.S. Brent Crude Oil is a blend of crude oil recovered from the North Sea in the early 1960s, whose price is used as a benchmark for the commodity's prices. The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners. UBS Bloomberg Constant Maturity Commodity Index is a total return rules-based composite benchmark index diversified across commodity components from within specific sectors.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The securities/ financial instruments discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security/financial instrument, or to participate in any trading strategy.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.