MAD Macro - It's The Saudis' Fault

I Thought We Had A Deal

The NYT has found someone to blame for any disappointing 2022 election outcomes. It’s the Saudis’ fault. The paper of record is breaking a story today that the Biden administration had a secret deal with the Saudis to increase oil production through year-end. Apparently, when Biden fist bumped MBS (Crown Prince Mohammed bin Salman) his administration thought they had a secret deal. Just in case anyone missed the point of the article, they also ran a second story saying that the Biden administration believes that the Saudis are attempting to meddle in the upcoming U.S. elections. The story also tied the Saudi double cross to Trump. They pointed out that Jared Kushner has a front row seat at this week’s investor conference in Riyadh. Interestingly, the second story has been removed. Maybe the NYT thought it was a little early to run the story of Saudi-Trump collusion. First they need to find or create the Trump-Saudi dossier. Where is Cristopher Steele when you need him?

Speaking of conspiracy theories I am wondering if Jay Powell has already been forced to pivot monetary policy. First we find out the SNB is possibly funding Credit Suisse’s balance sheet while they look to sell assets and raise capital. Then the BOJ has the U.S. Fed intervene in the currency markets on their behalf late Friday afternoon. Maybe the BOE was also asking the U.S. Fed to pause tightening so their pension system can sell assets. Hard to know but it does feel like the U.S. Fed might be blinking. Has market stability become the priority? We will need to wait for next week’s Fed meeting to find out. If that’s the case risk assets could stage a strong rally in the short-term.

Risk assets are a little lower this morning because of disappointing earnings from Google. U.S. interest rates and the dollar are also lower which should support risk assets.

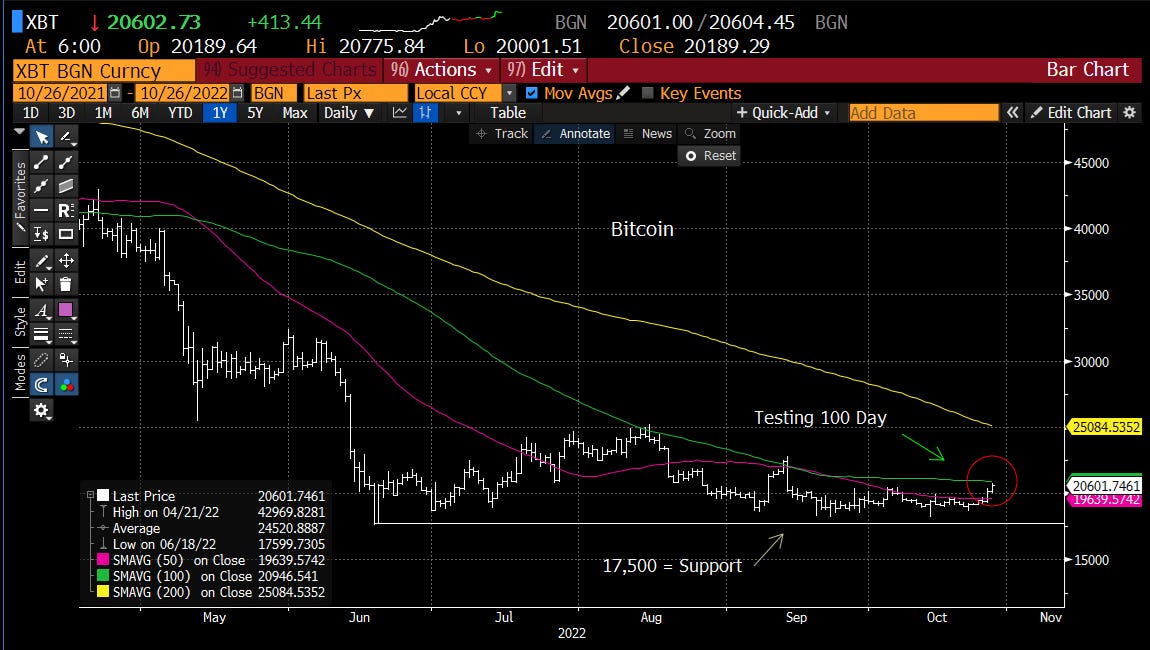

I updated the U.S. dollar index, Japanese yen, British pound, U.S. 10yr yield, S&P futures, NASDAQ 100 futures, bitcoin and spot gold charts below.

The U.S. dollar index is breaking below the 50 day average today. If the Fed has paused the U.S. dollar could decline sharply.

Both the British pound and Japanese yen are stronger this morning.

U.S. 10yr yields are slightly lower but remain in a steep uptrend. If the Fed is pivoting will 10yr rates fall or rise? It’s a good question and I don’t have a strong opinion. Rates could fall first but if investors think inflation will rise, 10yr rates could continue rising.

S&P and NASDAQ 100 futures are slightly lower this morning but off of overnight lows.

Bitcoin had a good rally yesterday and is testing the 100 day average and the top of the recent trading range.

Spot gold is testing the important $1,675 to $1,695 resistant area this morning. If the Fed is blinking gold could take off like a rocket ship.

IMPORTANT DISCLOSURES AND DEFINITIONS

Unless otherwise stated, Bloomberg is the source of all data and charts.

S&P 500 futures are a type of derivative contract that provides a buyer with an investment priced based on the expectation of the S&P 500 Index’s future value. Nasdaq 100 futures are commodities futures products traded within the equity futures sector. West Texas Intermediate (WTI) oil is a benchmark used by oil markets, representing oil produced in the U.S. Brent Crude Oil is a blend of crude oil recovered from the North Sea in the early 1960s, whose price is used as a benchmark for the commodity's prices. The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners. UBS Bloomberg Constant Maturity Commodity Index is a total return rules-based composite benchmark index diversified across commodity components from within specific sectors.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The securities/ financial instruments discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security/financial instrument, or to participate in any trading strategy.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.