MAD Macro - Hey You Trusted Us

You F—ked-Up, You Trusted Us

Hey, You F—ked-Up, You Trusted Us

MAD Macro Will Publish Sunday And Monday Night Next Week

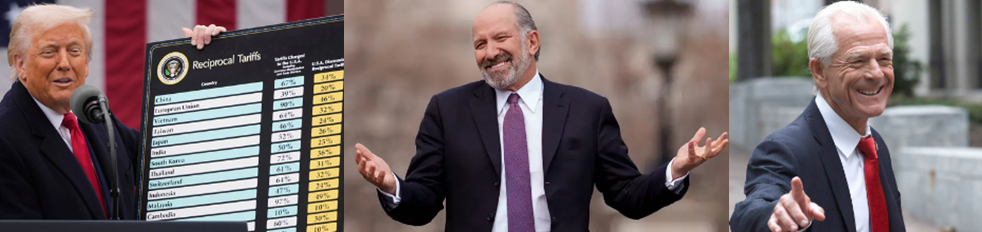

I wonder how long Trump, Lutnick and Navarro can stand the pressure of a market freefall. They seemed unconcerned yesterday. Maybe that’s what they wanted, market disruption. One very big problem for Trump is that half of the world is rooting against him. The NYT is almost gleeful that the market is falling. I know it’s dangerous, but I was thinking about the U.S. dollar in the middle of the night last night. Trump is right that we have been treated unfairly by some of our trading partners. But these global trade terms evolved over a very long time following WWII. In return for encouraging global trade by offering favorable terms, the world and the U.S. grew and the world is better for it. In return, the U.S. received an invaluable benefit. The dollar is the world’s reserve currency. Trump’s obsession with trade deficits and his tariff war to fix them might also end the U.S. dollar’s reserve currency status. If that happens, what becomes the global reserve currency? GOLD.

China fired back this morning. I did my charts before the news. The market has taken another big leg lower. China retaliated with a 34% tariff on U.S. goods. They are stopping agriculture imports from the U.S. They are also cutting off rare earth mineral exports. Yesterday, the ghosts of Hoover, Smoot and Hawley escaped. Today is starting to look like Black Friday 1929. I can’t think of anything funny this morning. The only thing slightly funny is that Trump has declared a national emergency to impose the announced tariffs. By declaring a national emergency to tariff the world, he has created a real national emergency.

Markets are scary this morning. Investors are seeing ghosts and there are no Ghostbusters to call. Crude oil is breaking below the the 2023 lows of $63.50, the last support on the charts. Gold was lower but is now higher. I think gold might be the only safe asset in the world. The world financial system is leveraged and fragile, it looks like Trump’s tariffs have broken the financial system. Bond yields are falling sharply and the dollar is unchanged. We get the monthly employment report today, but I am not sure anyone will notice or care.

I added an interesting chart of China’s and Japan’s holding of U.S. Treasuries. I updated the U.S. Dollar Index, added a U.S. Dollar Index monthly, U.S. 10yr yield, U.S. 10yr-2yr yield spread, WTI crude oil, NY copper, spot gold, NYSE Arca Gold Miners Index, bitcoin, Strategy, S&P futures, NASDAQ 99 futures and DOW futures.

The dollar is a little lower. I added a very long-term monthly dollar chart. I think it’s possible that the dollar is losing it’s reserve status and could fall sharply from here. Interest rates are falling sharply. The curve is a little steeper.

Crude oil is collapsing below the 2023 lows. Copper is also falling sharply. The commodity with a PHD in economics thinks we are going into a recession next week. Gold is higher and might continue higher as the only true safety asset. NYSE Arca Gold Miners Index should open higher. Bitcoin is a little lower, holding up better than other risk assets. Strategy should open a little lower.

The S&P, NASDAQ 99 and DOW futures are sharply lower.

IMPORTANT DISCLOSURES AND DEFINITIONS

Unless otherwise stated, Bloomberg is the source of all data and charts.

S&P 500 futures are a type of derivative contract that provides a buyer with an investment priced based on the expectation of the S&P 500 Index’s future value. Nasdaq 100 futures are commodities futures products traded within the equity futures sector. West Texas Intermediate (WTI) oil is a benchmark used by oil markets, representing oil produced in the U.S. Brent Crude Oil is a blend of crude oil recovered from the North Sea in the early 1960s, whose price is used as a benchmark for the commodity's prices. The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners. UBS Bloomberg Constant Maturity Commodity Index is a total return rules-based composite benchmark index diversified across commodity components from within specific sectors. Index performance is not illustrative of fund performance. It is not possible to invest directly in an index.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The securities/ financial instruments discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security/financial instrument, or to participate in any trading strategy.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.