MAD Macro - Blowing the Roof Off of the U.S. Treasury

IRA Inflation Recovery Act

The Debt Monsters Are Loose

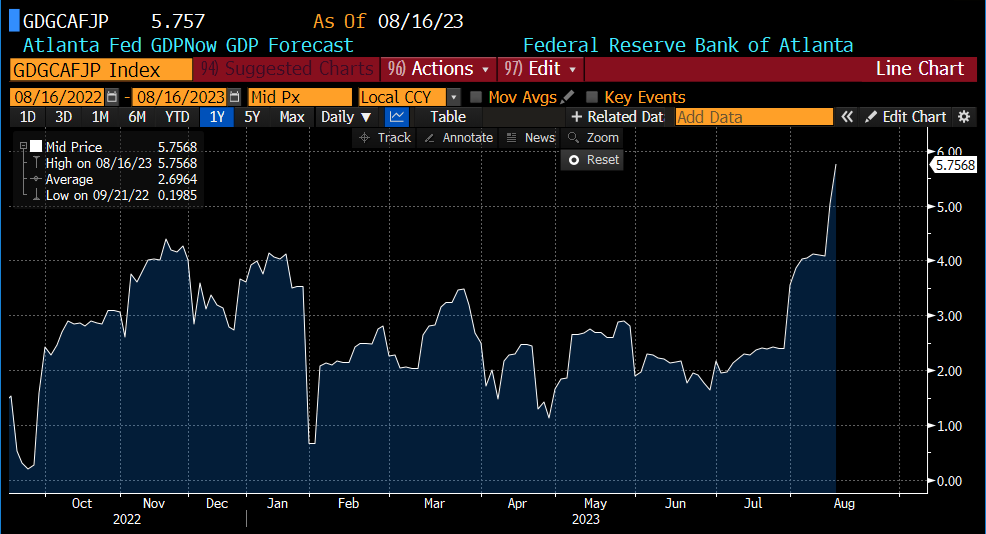

The Tin Man has been celebrating the one year anniversary of the IRA (Inflation Reduction Act) this week. Janet Yellen wrote an opinion article in yesterday’s WSJ, linked here. She thinks the IRA is the best thing since sliced bread. It’s a very good article titled “A Prosperous Year for the Inflation Reduction Act”. Janet calls it “modern supply-side” economics. Apparently, this is what we are now calling “Bidenomics”. Hopefully Janet is correct on what a wonderful thing the IRA is, but inflation reduction is still a terrible name. Maybe someday we might rename it the Inflation Recovery Act. In today’s WSJ, Steven Law writes a rebuttal to Janet’s article, linked here. It’s titled “The Inflation Reduction Act Flim-Flam”. The article sights research firm Wood Mackenzie’s IRA cost estimate of $2.8 trillion. Remember, it was originally sold as a $700 billion investment program. I still wonder which genius in Washington named this thing the Inflation Reduction Act. I guess the recent Atlanta Fed’s GDPNow tracking number for Q3 growth of 5.75% is a result of the wonderful IRA. I included the chart of the Atlanta Fed’s GDPNow chart today. It might not reduce inflation, but it is exploding the U.S budget deficits. Remember, Bill Ackman is short U.S. 30yr bonds on supply concerns and last week we had a soft 30yr auction. Since the auction, yields have been climbing and the curve has been steepening. It looks like the yield and yield curve containment grid has been turned off. It’s like what Bill Murray told the mayor in Ghostbusters, “This is Old Testament stuff, cats sleeping with dogs”.

The newest Orange Monster indictment looks like it will be great fun. CNN should have a fantastic year next year. Not only will it be televised, but apparently all 19 defendants will have mug shots taken when they turn themselves in next week. The judge is 34 years old with six months of experience. I was thinking maybe he could put all 19 defendants on trial at once. Just think, maybe they could have one of those cages like a WWII war crimes trial. The possibilities are limitless and the TV ratings will save traditional cable.

Markets are due slightly higher after two big down days. Both the S&P and NASDAQ 100 futures have broken below the 50 day averages and trend line support levels. 10yr yields are testing the intraday highs today and the yield curve is above the 200 day.

I added the Atlanta Fed GDPNow chart and updated the U.S. Dollar Index, U.S. 2yr yield, U.S. 10yr Yield, U.S. 10yr yield monthly, U.S. 10yr-2yr yield spread, WTI crude oil, spot gold, bitcoin, S&P futures and NASDAQ 100 futures charts below.

The Atlanta Fed’s Q3 growth estimate has surged to 5.75%. Thank God for the IRA. The U.S. dollar is testing a resistance level today. Long-term yields are slightly higher and the curve is a little steeper today. I included the 10yr yield monthly chart today for some perspective.

WTI crude oil has pulled back this week on the higher yields and stronger dollar. There is some minor support around the overnight lows. Spot gold is back below the 200 day and bitcoin is testing trendline support.

S&P and NASDAQ 100 futures are slightly higher today but both have broken the 50 day and trendline support levels this week.

IMPORTANT DISCLOSURES AND DEFINITIONS

Unless otherwise stated, Bloomberg is the source of all data and charts.

S&P 500 futures are a type of derivative contract that provides a buyer with an investment priced based on the expectation of the S&P 500 Index’s future value. Nasdaq 100 futures are commodities futures products traded within the equity futures sector. West Texas Intermediate (WTI) oil is a benchmark used by oil markets, representing oil produced in the U.S. Brent Crude Oil is a blend of crude oil recovered from the North Sea in the early 1960s, whose price is used as a benchmark for the commodity's prices. The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners. UBS Bloomberg Constant Maturity Commodity Index is a total return rules-based composite benchmark index diversified across commodity components from within specific sectors.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The securities/ financial instruments discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security/financial instrument, or to participate in any trading strategy.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.