MAD Macro - Another Day, Another Marble Palace

Nice Portrait, Who’s the Artist?

China Tariff Pause. Wait, No India Production?

Trump finished his Mideast sales tour. He did a lot of biggly deals. Trump is calling Trump the $2.2 Trillion Salesman. The NYT will be fact checking this. The trip also successfully isolated Iran. But the Houthis keep firing missiles into Israel. On the other hand, the anticipated Russia-Ukraine talks were a disaster. The C teams are meeting today in Istanbul. The WSJ is covering both good Trump and bad Trump. The NYT has a bad case of TDS, so understandably they are only focused on bad Trump.

You have to feel sorry for Tim Cook. First, he is going to get crushed by the China tariffs, $3,000 iPhones. He starts planning to move production to India. Then his dreams come true and Bessent talks Trump off of the tariff ledge. Bessent and China have a trade agreement, sort of. Tim can cheer for one day, but only one day. Then Trump tweets that Tim should not move so much production to India but needs to move it to the U.S. Poor Tim is thinking, YIKES, $3,000 iPhones again.

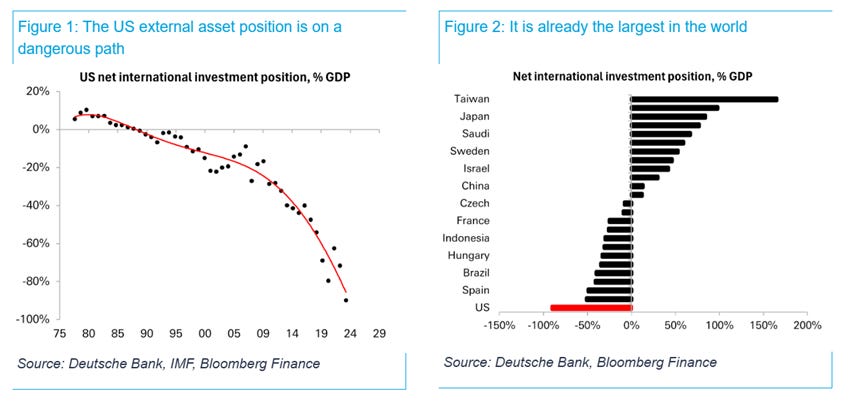

With Trump returning to Washington, the media and markets will start focusing on the “Big Beautiful Bill” (BBB) next week. It’s pro-growth, but it’s also pro-deficits. There are two good articles in today’s WSJ about the BBB. Greg Ip has a good one, linked here. It’s titled, “The Tax Code Gets a MAGA Makeover”. Kimberley Strassel has another in the WSJ opinion pages, linked here. It’s titled, “Trump’s Moment of Budget Reform Truth”. Both articles point out that the BBB does not change the trajectory of U.S. budget deficits. There appears to be zero attempt to reform Biden’s spending problem. Actually, as we now know, it’s not Biden’s spending problem, it’s Jill and Jake the Snake Sullivan’s spending problem. This is a game of chicken as we drive straight towards the fiscal cliff. The fiscal problem has always been the big risk. The Tariff Temper Tantrum distracted everyone from the fiscal problems. I think next week, markets will refocus on the fiscal problems. That could mean a steeper yield curve, rising long-term U.S. rates and a lower dollar. I included two interesting charts of the U.S. NIIP (Net International Investment Position). Sell the dollar and buy gold.

Markets are a little higher this morning. Interest rates are a little lower after falling yesterday on weak economic reports.

I updated the U.S. Dollar Index, U.S. 10yr yield, U.S. 10yr-2yr yield spread, WTI crude oil, NY copper, spot gold, NYSE Arca Gold Miners Index, bitcoin, Strategy, S&P futures, NASDAQ 99 futures and DOW futures charts below.

The dollar is slightly higher and interest rates are a little lower.

Crude oil is unchanged and copper is a little lower. Gold is lower testing the 50 day average again. I think this is another buying opportunity. The NYSE Arca Gold Miners Index should open lower with gold prices. Bitcoin is unchanged and Strategy is also due unchanged.

S&P, NASDAQ 99 and DOW futures are a little higher.

IMPORTANT DISCLOSURES AND DEFINITIONS

Unless otherwise stated, Bloomberg is the source of all data and charts.

S&P 500 futures are a type of derivative contract that provides a buyer with an investment priced based on the expectation of the S&P 500 Index’s future value. Nasdaq 100 futures are commodities futures products traded within the equity futures sector. West Texas Intermediate (WTI) oil is a benchmark used by oil markets, representing oil produced in the U.S. Brent Crude Oil is a blend of crude oil recovered from the North Sea in the early 1960s, whose price is used as a benchmark for the commodity's prices. The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to the value of a basket of currencies of the majority of the U.S.'s most significant trading partners. UBS Bloomberg Constant Maturity Commodity Index is a total return rules-based composite benchmark index diversified across commodity components from within specific sectors. Index performance is not illustrative of fund performance. It is not possible to invest directly in an index.

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck. The securities/ financial instruments discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security/financial instrument, or to participate in any trading strategy.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.